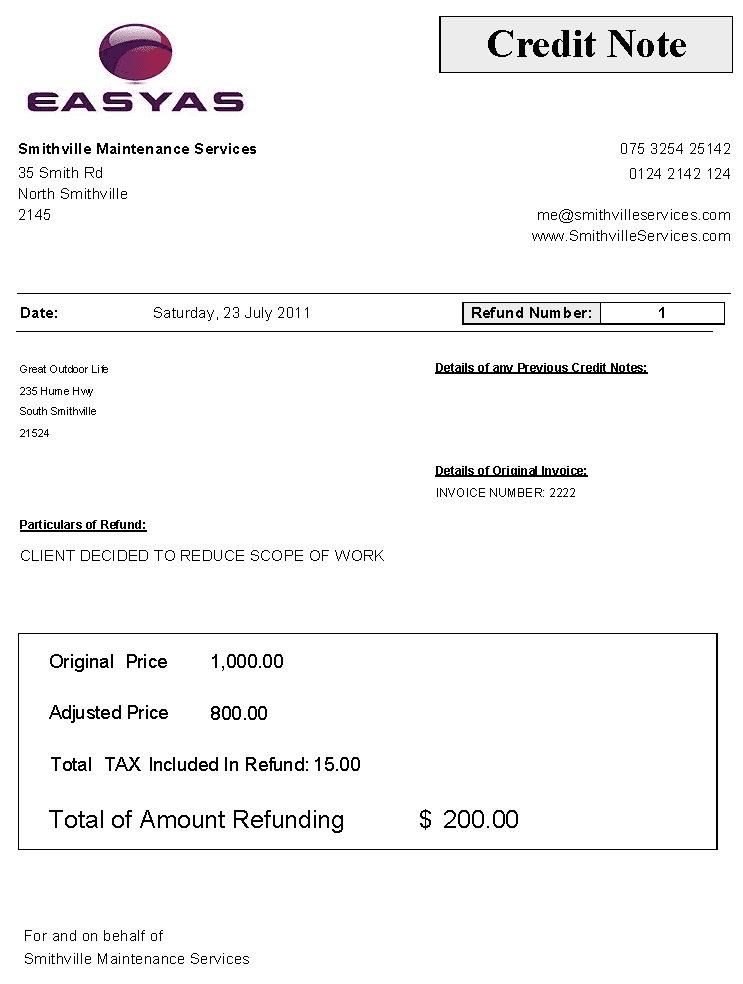

Credit Note – Refund

Included in our Credit Note is a ability to record Tax Refund amounts. When refunding or crediting a client, you need to also pay attention to any Sales Tax that may have been included on the Original Invoice.

As a whole we don’t believe many Small Businesses, Contractors and Subcontractors using our computer accounting software will use credit notes (maybe only 5% of our clients). We say this because our software is dedicated and aimed towards the Small Business end of the market and the use of Credit Notes is not typically seen in large amounts.

However we understand that an element of business do issue credit notes as part of their operation, which is why Credit Notes are included with the EasyAs Software, but using our own style.

Shopping Refunds

It is widely understood that you can go to the shopping center down the road and receive credit on items you return. Usually these businesses use some form of computerized accounting system that is tied with the cash register and everything is kept neat and tidy.

.

Below is a sample of a credit note showing two forms of Sales Tax which is typical for parts of Canada. For those countries such as Australia & the USA who only use one form of Sales Tax the Credit Note will appear without this additional reference: